In the past year, eBay’s stock has risen by 17.57 percent. Amazon’s stock has risen by 40.92 percent. It’s possible to argue that eBay might learn a thing or two from Amazon, then, and an analyst at RBC Capital has done so by suggesting that eBay launch a program similar to Fulfillment by Amazon.

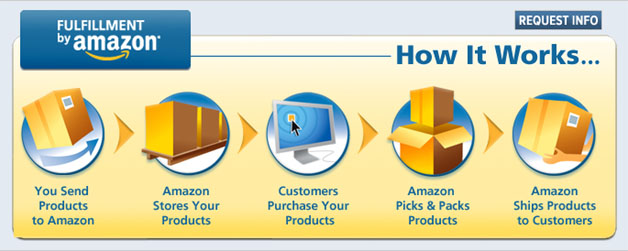

Below, you can see a diagram of how Fulfillment by Amazon works if you’re unfamiliar with the arrangement. It makes Amazon an integral part of all buying and selling processes, which is good for the company. It also helps reduce shipping costs (and times), which benefits the buyers and sellers.

Implementing a similar program would then have at least one other benefit in eBay’s case, according to RBC’s Stephen Ju. As reported by Eric Savitz, Ju said, "Most importantly, this measure would help EBAY to shed its Web 1.0 image and remain more relevant to its base of buyers and sellers."

eBay may want to make some changes sooner rather than later, too. Savitz reported, "Ju maintains his Outperform rating on the shares, but cuts his target to $25, from $30. He cut his 2010 EPS forecast to $1.62, from $1.64; for 2011, he goes to $1.79, from $1.82."

So perhaps eBay’s shareholders can start to apply a little pressure if they feel the fulfillment program is a good idea. Launching it would represent a big change from eBay’s traditional way of doing business, though, so no one should expect John Donahoe to greenlight the project on a whim.

WebProNews is an iEntry Publication

WebProNews is an iEntry Publication